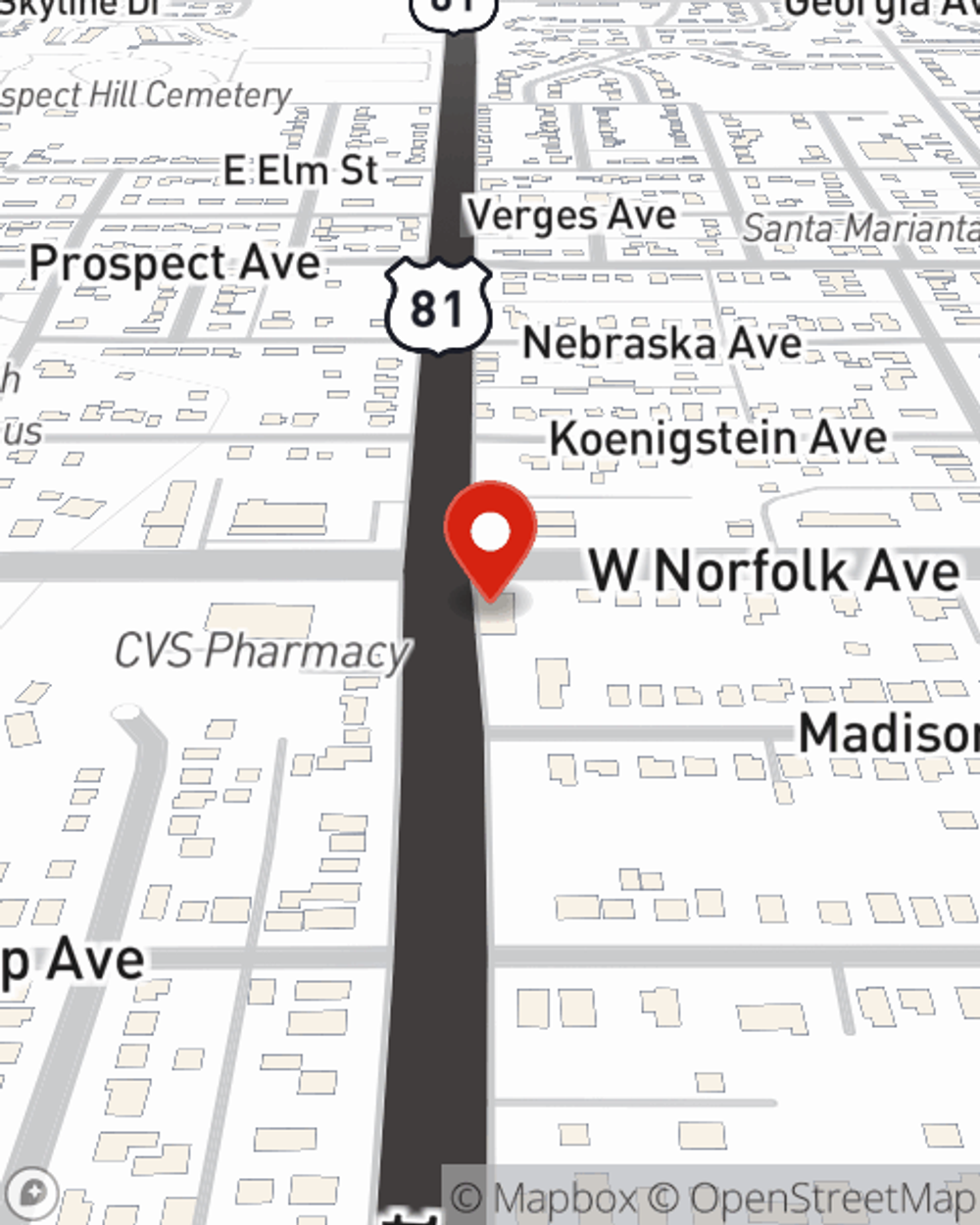

Renters Insurance in and around Norfolk

Get renters insurance in Norfolk

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Columbus, NE

- Fremont, NE

- Lincoln, NE

- Grand Island, NE

- Battle Creek, NE

- Pierce, NE

- Sioux City, IA

- Omaha, NE

- Yankton, SD

- Le Mars, IA

- Sioux Falls, SD

Insure What You Own While You Lease A Home

Home is home even if you are leasing it. And whether it's a townhome or a condo, protection for your personal belongings is good to have, whether or not your landlord requires it.

Get renters insurance in Norfolk

Coverage for what's yours, in your rented home

There's No Place Like Home

It's likely that your landlord's insurance only covers the structure of the apartment or space you're renting. So, if you want to protect your valuables - such as a microwave, a video game system or a dining room set - renters insurance is what you're looking for. State Farm agent Dana Liebig is dedicated to helping you evaluate your risks and keep your things safe.

Don’t let the unknown about protecting your personal belongings stress you out! Reach out to State Farm Agent Dana Liebig today, and see the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Dana at (402) 379-2014 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Dana Liebig

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.